Understanding the Landscape of Crypto-Friendly Countries

The rapid evolution of blockchain technology and cryptocurrencies has transformed the financial sector worldwide. As digital assets become more mainstream, the importance of locating jurisdictions that foster a supportive environment for crypto activities has grown significantly. For investors, entrepreneurs, and enthusiasts alike, understanding what constitutes a crypto-friendly countries is essential for strategic decision-making—especially amid ongoing regulatory developments. Today, we delve into the defining features, current trends, and future outlooks of nations that nurture the growth of crypto markets.

What Defines a Crypto-Friendly Country?

At its core, a crypto-friendly country is one that offers clear legal frameworks, accessible regulatory policies, and a stable operational environment for cryptocurrency usage, trading, and business activities. Unlike jurisdictions where crypto is outright banned or heavily restricted, these countries typically implement progressive regulations that encourage innovation and provide safety for investors and companies.

Key characteristics include:

- Legal Clarity: Transparent legal statutes regarding cryptocurrencies, ensuring users and businesses understand their rights and obligations.

- Tax Policies: Favorable tax regimes or exemptions that attract crypto investors and entrepreneurs.

- Business Environment: Accessible licensing processes for crypto exchanges, wallets, and blockchain startups.

- Financial Infrastructure: Availability of banking services and integration with traditional financial systems.

- Technological Ecosystem: Supportive innovation hubs and communities fostering blockchain developments.

Key Factors Influencing Crypto Legislation

Legislative climates pivot on multiple variables, including geopolitical stability, economic openness, and technological readiness. Countries embracing crypto often prioritize:

- Regulatory Frameworks: Establishing comprehensive laws—such as licensing requirements, anti-money laundering (AML), and know-your-customer (KYC) standards—that balance innovation with security.

- Government Attitudes: Leadership’s stance on digital assets, whether proactive support or cautious regulation.

- Global Trends: Alignment with international standards set by entities like the Financial Action Task Force (FATF) or European Union directives.

- Market Demand: Domestic interest and acceptance of cryptocurrencies drive legislative approaches.

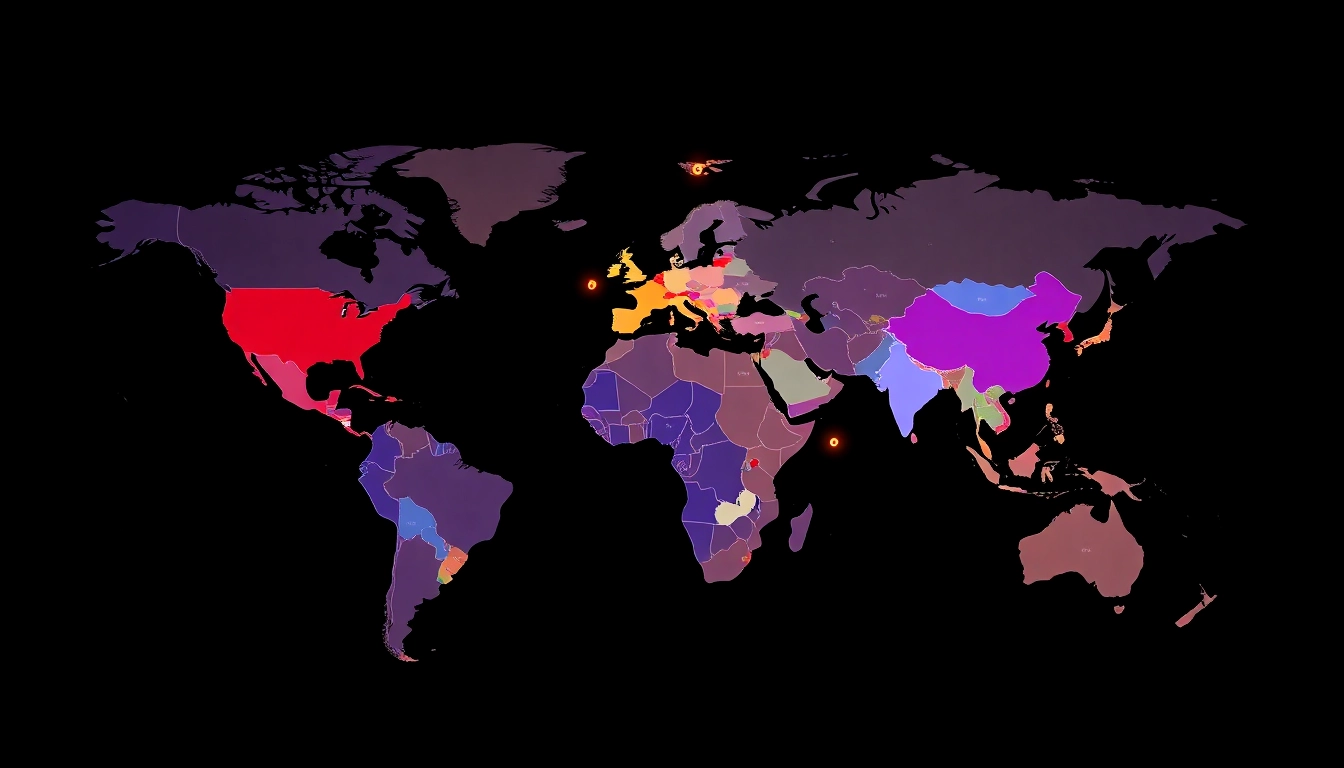

Current Global Trends in Cryptocurrency Regulation

As of 2025, the regulatory landscape continues to shift dynamically. Notable trends include:

- Licensing & Registration: Countries such as Switzerland and Singapore have streamlined licensing processes, offering clear pathways for crypto businesses.

- Tax Harmonization: Some nations, like Portugal, maintain policy frameworks where crypto gains are tax-free, making them attractive locales for investors.

- Innovation Laws: The introduction of legislation supporting initial coin offerings (ICOs), security token offerings (STOs), and decentralized finance (DeFi) services.

- Global Cooperation: Increased international collaboration aims to regulate cross-border crypto activities effectively.

Leading Nations Offering Favorable Crypto Environments in 2025

Switzerland’s Crypto Valley and Its Regulatory Framework

Switzerland remains the epitome of a crypto-friendly jurisdiction, largely due to its renowned Crypto Valley centered in Zug. The Swiss government provides clear, progressive regulations, including exemptions from VAT for certain crypto transactions and a streamlined licensing process for blockchain companies. Its legal framework provides certainty, stability, and encourages innovation, making it a magnet for global crypto startups and established firms alike.

Furthermore, Switzerland’s commitment to blockchain development is exemplified through initiatives like the Swiss Blockchain Federation, promoting a collaborative ecosystem that blends legal safety with technological advancement.

Portugal and Its Tax Benefits for Crypto Investors

Portugal continues to attract crypto enthusiasts with its unique tax regime—cryptocurrencies are generally tax-exempt for individual investors, provided the activity isn’t classified as professional or business income. This policy makes Portugal especially appealing for long-term investors and expatriates looking to maximize returns without the burden of high taxes.

Additionally, Portugal is embracing blockchain innovation through regulatory clarity and support for startups, fostering a resilient environment for crypto-related businesses. Its relatively low cost of living, combined with a friendly regulatory climate, enhances its attractiveness as a crypto hub in Europe.

Singapore’s Strategic Position as a Crypto Hub

Singapore has long been recognized as Asia’s leading financial center, and its progressive stance on cryptocurrencies solidifies its position. The Monetary Authority of Singapore (MAS) has established comprehensive licensing regimes for digital payment services and crypto exchanges, providing legal certainty amid a rapidly evolving landscape.

Besides regulatory clarity, Singapore offers a robust financial infrastructure, a highly skilled workforce, and a proactive government that supports technological innovation. As a result, numerous blockchain startups and crypto funds have set up shop in Singapore, leveraging its strategic geographic location and business-friendly policies.

Strategies for Selecting the Right Crypto-Friendly Country

Evaluating Tax Policies and Legal Clarity

When choosing a crypto-friendly jurisdiction, tax policies are often decisive. Countries like Portugal or Switzerland offer beneficial regimes such as tax exemptions or low tax brackets, optimizing potential profits. Concurrently, legal clarity reduces uncertainties, providing assurance for long-term planning.

Assess whether the country’s regulations address your specific crypto activities—be it trading, investing, or establishing blockchain enterprises—and scrutinize the legal environment’s stability over time.

Assessing Business and Residency Opportunities

For entrepreneurs and digital nomads, evaluating residency options and business registration procedures is pivotal. Countries with streamlined visa processes, supportive startup ecosystems, and accessible banking services—like Singapore or Estonia—are more attractive for establishing operations and flexible residency arrangements.

Understanding the criteria for residency, tax obligations, and banking access can significantly affect your decision-making process.

Understanding Compliance and Regulatory Stability

Regulatory environments that demonstrate consistency and transparency are preferable. Countries that frequently update their laws or show signs of restrictive policies can pose risks to crypto ventures. Prioritize jurisdictions that provide a clear regulatory roadmap, with institutions actively engaging in dialogue with industry stakeholders.

Monitoring policy shifts and staying informed about legislative changes can mitigate future compliance challenges.

Challenges and Risks in Moving to Crypto-Friendly Countries

Legal Uncertainties and Changing Regulations

Despite the appeal, the legal landscape may evolve unpredictably, leading to risks of increased regulation, taxation, or outright bans. Countries that are currently supportive might impose restrictions if political or economic priorities shift.

Mitigation strategies include thorough legal due diligence, diversifying holdings across jurisdictions, and maintaining compliance agility to adapt swiftly to legislative changes.

Tax Implications and Financial Considerations

Even in crypto-friendly countries, understanding the tax obligations is vital. Some jurisdictions may have complex reporting requirements or unexpected tax liabilities that can affect profitability. Consulting with local tax experts helps ensure compliance and optimal tax planning.

Additionally, consider the stability of the financial infrastructure—access to banking, payment gateways, and the ability to convert crypto into fiat currencies smoothly are crucial factors.

International Mobility and Residency Requirements

Residency permits, visa requirements, and the ease of moving between countries influence the practicality of establishing a crypto base abroad. Countries like Malta or Portugal offer favorable schemes, but bureaucratic hurdles or stringent criteria can pose challenges.

Pre-planning and legal guidance are essential in navigating immigration processes and maintaining flexibility in international mobility.

Future Outlook: Trends That Will Shape Cryptocurrency Acceptance Worldwide

The Impact of Global Policy Shifts

International cooperation and policy harmonization will likely shape the global crypto landscape. Standardized regulations and cross-border agreements aim to facilitate legitimate crypto trade while combating illicit activities.

As major economies like the US, EU, and China refine their approaches, smaller nations may follow suit or adapt to attract crypto businesses seeking regulatory certainty.

Emerging Countries to Watch in 2025

While established hubs continue leadership, emerging markets like Dubai, El Salvador, and certain African nations are increasingly positioning themselves as crypto-friendly jurisdictions. These countries often combine strategic incentives with regulatory openness, making them prime candidates for future growth.

Monitoring political stability, economic policies, and legislative developments in these regions is crucial for long-term planning.

Adapting to Evolving Regulatory Environments

Flexibility and proactive engagement with regulators will be vital for success. Businesses and investors should remain informed and adaptable, leveraging consulting services, industry analyses, and participation in regulatory consultations to stay ahead.

The dynamic nature of the crypto sector demands continuous compliance review and strategic agility to capitalize on emerging opportunities and mitigate risks effectively.